Frequently Asked Questions

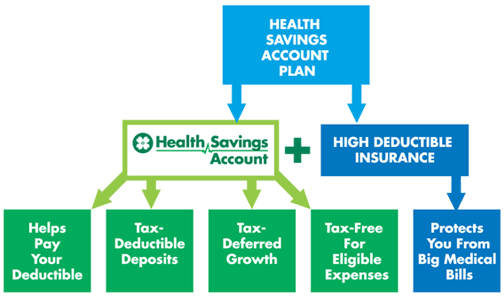

Your Health Savings Account (HSA) coupled with a High Deductible Health Plan (HDHP) can help you save money on your medical expenses. By choosing the HDHP you can save significantly on your health care premiums.

General Information

A Health Savings Account (HSA) is what you get when you combine a high-deductible health insurance plan and a tax-exempt savings account. They are designed to allow individuals to use pre-tax dollars to help pay for current and future medical expenses.

HSAs offer a triple tax advantage:

- Contributions are 100 percent tax-deductible for the account holder.

- Funds grow on a tax-deferred basis and funds are not taxed if used for an eligible expense.

- After age 65, funds can be used tax-free for eligible expenses, including Medicare premiums, or taxed with no penalty for other expenses.

Taking money out of your HSA is as easy as taking money out of your checking account. There are no claims to file - you simply swipe your HSA debit card or use Online Bill Pay. If you choose to reimburse yourself for eligible expenses, you can simply make a funds transfer using Online Banking, using Online Bill Pay or withdrawal funds at an ATM.

Yes. Your HSA funds can be used for your spouse and dependent children's out-of-pocket eligible expenses, even if they are not on your health plan. Please remember that no one in your family can have a medical FSA if you have an HSA.

HSAs are individual accounts based on IRS rules. If you’re both covered by a qualified HDHP, you can each setup accounts or you can run all expenses through one account.

You need to spend the funds in your FSA by the end of the year, so you can be eligible to have an HSA at the beginning of the plan year starting January 1.

- No use it or lose it rules

- Unspent balances in accounts remain in the account until spent

- Accounts can grow through investment earnings, just like an IRA

Enrollment and Contributions

No. If you already have an account, MOFB payroll contributions will be made to that account anytime you are enrolled in the HDHP.

- Contact Ronda Bryant with MOFB Payroll at ronda.bryant@mofb.com or (573) 893-1457.

- Make a funds transfer through HSACentral.net or the HSA Central mobile app

- Visit a Central Bank branch

Contact Human Resources for more information about HSA Contribution eligibility.